The market for foreign exchange processes more than $7.5 trillion daily in trading volume making it the largest financial market. Yet, 80percent of new forex traders fail to make money within the first year of trading. What is the key to success or failure? A solid trading strategy.

Forex trading strategies are your guide through the confusing market of exchange rates. They assist you in making well-informed decisions to manage risk effectively and increase confidence in your trading method. Without a well-tested strategy, you’re simply playing with your money.

This guide will help you learn five forex trading strategies for beginners which can aid you in navigating the market landscape of 2025 successfully. We’ll provide practical advice along with real-world examples of common mistakes to avoid when you begin your journey to trading.

Why Forex Trading Strategies Matter for Beginners

Think of strategies for trading currencies as GPS navigation for your financial journey. As you wouldn’t drive to a new location without a map You shouldn’t be trading forex without a plan.

Effective trading strategies bring three crucial advantages:

Risk Management Strategies aid you in determining the right size for your position, establish stop-losses, and ensure your capital is protected from catastrophic losses.

Emotional Control: A predetermined plan can help you avoid the risk of making decisions impulsively driven by greed or fear. When markets turn against you the strategy you have in place keeps you on track.

Consistency Achieving success in trading doesn’t come from a single huge win. It’s about sustaining profitable trades over the course of time. Strategies develop repeatable processes that provide steady returns.

Strategy #1: Trend Following

Trend following is among the most reliable strategies for trading forex for novice traders. The principle behind it is simple to determine the direction of market movements and then trade in that direction. There is an old saying “Trend is your friend”.

How Trend Following Works

Currency pairs tend to change direction in a steady manner for months or even weeks. If you can spot these trends early you can be positioned to profit from the continued momentum. The key is identifying the moment when a trend starts and then riding it until clear signals of reversal are evident.

Popular indicators for tracking trends are:

- Moving averages (20-day and 50-day)

- MACD (Moving Average Convergence Divergence)

- ADX (Average Directional Index)

Practical Implementation

Begin by identifying the major currency pairs that show clear direction. Check for EUR/USD, GBP/USD or USD/JPY charts that always make higher highs and lower lows (uptrend) or lower highs and lower lows (downtrend).

Signs of entry

- Price is able to break above an earlier resistance level

- Moving averages cross paths in the direction of trend

- Volume increases during trend shifts

Exit strategies:

- Set stop-loss levels 3 to 4 percent below the entry point

- Profit when trend indicators show a weakening of momentum

- Trail stops to secure gains as trends develop

Common Pitfalls to Avoid

Many new traders are caught up in trend too late, either buying at the peak or selling at bottoms. Make sure to wait for confirmed breakouts and a strong volumes before committing to positions.

Another error is to hold positions for too long after signals of trend reversal are evident. Set clear exit requirements and stick to them even if it leaves any potential gains on the table.

Strategy #2: Range Trading

Range trading is a way to profit from currency pairs that fluctuate within the bounds of price. This strategy is especially effective in conditions of stability when major economic events don’t cause significant fluctuations.

Understanding Range-Bound Markets

Currency pairs typically fluctuate between resistance and support levels for long periods of time. Support is the floor at which interest in buying begins to emerge and resistance is the top of the mountain where selling pressure is increasing.

Trading in range involves buying close to support levels, and selling at resistance levels, gaining from these dependable price movements.

Identifying Trading Ranges

Find for the currency pairs that have traded at the same price range for at minimum two weeks. The more diverse the range the better chance of profit is available for every trade.

Key identification requirements:

- Multiple touches of resistance and support levels

- Low overall volatility

- There is no sign of a major trend

Execution Tips

Entry points:

- Purchase within 10-20 pip of the support levels

- Buy within 10-20 pip of resistance levels

- Limit orders can be used to automatically enter positions

Risk management:

- Set stop-losses to just above support level or below the resistance levels

- Target profit levels are located near the boundary of the opposite range

- Reduce the size of positions If ranges shrink significantly

Examples of range trading strategies:

Range Trading Challenges

The greatest risk with trading ranges occurs when ranges are triggered unexpectedly. Always look out for breakout signals, and be ready to exit positions that are losing money quickly.

Additionally, ranges can last longer than anticipated, which can tie up capital in positions that move sideways. Take into consideration time-based exits in case trades haven’t met profits within a reasonable timeframe.

Strategy #3: Breakout Trading

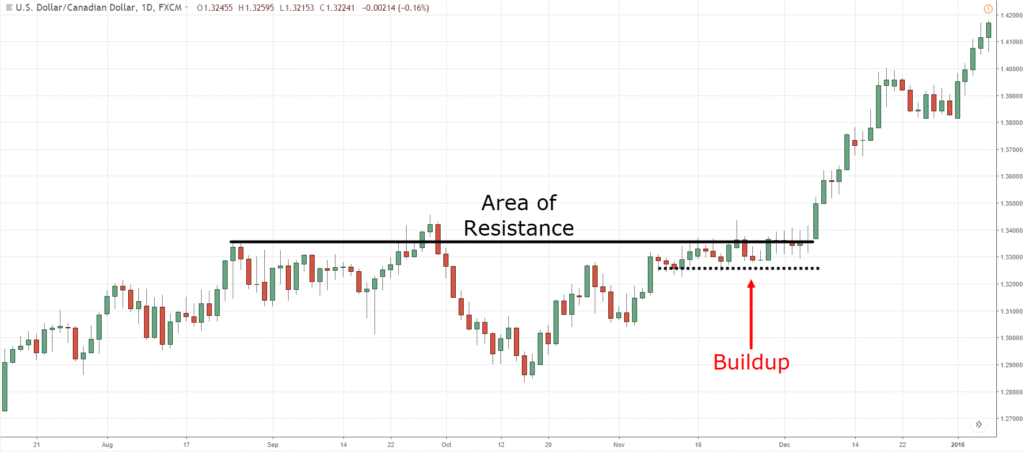

Breakout trading is focused on capturing major price movements when currencies cross established resistance or support levels. These breakouts typically result in large trending movements, which makes them appealing for novice traders looking to make bigger profits.

The Psychology Behind Breakouts

Breakouts occur when the accumulated selling or buying pressure exceeds current price barriers. When these barriers are removed prices tend to continue to move in the direction of breakouts because new traders take part in the trend.

Understanding this psychology will help you to position yourself in a favorable way before major decisions are made.

Identifying Breakout Opportunities

Chart patterns that signal potential breakouts

- Triangles (ascending, descending, symmetrical)

- Flags and Rectangles

- Head and shoulder formations

Volume confirmation

The most reliable breakouts are usually associated with a higher volume of trading. This indicates that a large number of players in the market drive price movement.

Breakout Trading Execution

Entry requirements:

- The price closes below resistance or above support

- The volume increases during the breakout

- The follow-through process occurs in the following trading sessions.

Stop-loss placement:

Stop-loss stops are placed in the previous boundary of the range. This helps to prevent false breakouts and allows space for normal price fluctuation.

Profit goals:

Find how high the prior trading range was, and then project the distance to the price of breakout. This will give you a realistic profit goal based upon previous price patterns.

Examples of Breakout trading strategies:

Managing False Breakouts

False breakouts are the main problem with this strategy. Prices can briefly breach resistance or support levels prior to getting back to their previous levels.

Strategies for protecting:

- Keep an eye out for confirmation of closings that surpass the key levels

- Multiple timeframes are required to confirm breakouts

- Reduce the size of your position until breakouts are verified as legitimate

Strategy #4: Carry Trading

Carry trading capitalizes on rates of interest differentials between currencies. By holding currencies with higher yields against those with lower yields traders receive daily interest payments and could also be making money from price movements that are favorable.

How Carry Trades Generate Profits

Central banks establish different rates of interest for their currency. If you purchase a higher-interest rate currency with a low-interest rate you’ll earn the difference each day.

For example, if Australian dollar is offering an interest rate of 4% while the Japanese yen provides 0.1 percent, a the AUD/JPY pair will earn you around 3.9 per cent annually in interest earnings.

Selecting Carry Trade Pairs

High yielding currency (as in 2025):

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

- Turkish Lira (TRY)

Low-yielding currencies:

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- Euro (EUR)

Trade pairs for popular carry:

- AUD/JPY

- NZD/JPY

- EUR/TRY

Carry Trade Considerations

Carry trades are best in safe, risk-free market conditions. When there is uncertainty in the economy or market turmoil, traders retreat to safe-haven currencies, creating significant losses in carry positions.

Risk factors:

- Changes in the policy of Central Bank

- Economic instability in high yield countries

- Global risk sentiment shifts

Position sizing:

Utilize smaller size positions for carry trades as they’re usually held for months, not days or weeks.

When to Avoid Carry Trading

Avoid carry trades during:

- Central bank meeting weeks

- Economic uncertainty is a major concern

- High market volatility during periods of high volatility

- In the event that technical analysis suggests trend reverses

Strategy #5: News Trading

News trading profit from the market’s volatility in relation to scheduled economic announcements as well as unexpected events. The price of currencies can fluctuate rapidly following news announcements which creates profit opportunities for experienced traders.

Understanding Market-Moving News

Economic releases with high impact:

- Non-farm payrolls (US employment data)

- Central bank interest rate decisions

- GDP announcements

- Inflation reports (CPI PPI, CPI)

Events in geopolitics:

- Political developments and elections

- Trade negotiations

- Natural disasters affecting major economies

- Tensions or conflicts between military forces

News Trading Approaches

Pre-announcement positioning:

Some traders place their bets on the expected announcements, according to forecasts and market sentiment. This strategy requires careful examination of consensus expectations and probable outcomes.

Post-announcement reaction:

Many beginners have success trading on the immediate response to news announcements. This is done by sitting and waiting for the announcement, and then immediately putting positions into the direction of the price’s initial movement.

Implementation Guidelines

Steps to prepare:

- Check the economic calendars for coming announcements

- Know the market expectations for every announcement

- Choose the those currency pairs that are most likely to be affected

- Create trading platforms for rapid execution

Timing of execution:

- Trades can be made within 1 to 2 minutes of news releases.

- Market orders can be used for immediate fills

- Set a tight stop-loss limit to guard against reverses

News Trading Risks

News trading is a risky business that beginners must be aware of:

Spread-widening Brokers tend to expand spreads during times of high volatility which can increase trading costs.

Slippage Market orders could be filled at significantly different prices than anticipated in volatile times.

Whipsaws Prices can be able to move quickly in a single direction but then quickly reverse, prompting stop-losses before returning to the trend.

Risk Management Across All Strategies

Whatever strategy you pick, proper risk management is essential for longevity. Even the best strategies are not effective without proper risk control.

Position Sizing Guidelines

Don’t place more than 1 percent of the balance in your account on a single trade. This method of prudent risk management assures that losing streaks won’t cause financial ruin to your account.

Calculation example:

- Balance of account at $10,000

- Maximum risk per trade: 2% = $200

- Stop-loss distance: 50 pips

- Position size: $200 / 50 pips = $4 per pip

Stop-Loss Best Practices

Always set stop-losses prior to trading. Choose your exit point based on the technical levels, not on arbitrary percentages.

Effective strategies to stop losses:

- Stops are placed beyond the critical support/resistance levels.

- Make use of trailing stops in order to secure profits from profitable trades

- Set stops based on the measurements of volatility

- Never move stops that are not in your position

Diversification Benefits

Don’t put all your trades into the same currency or in single strategies. Diversification helps reduce risk in the overall portfolio and smooths the return patterns.

Diversification strategies:

- Multi currency exchange

- Combine different time horizons

- Utilize a variety of trading strategies simultaneously

- Trades that are range-bound and directional

Subscribe to tradeguide.io get the latest information related to forex trading.

The content provided by tradeguide.io does not include financial advice, guidance or recommendations to take, or not to take, any trades, investments or decisions in relation to any matter. The content provided is impersonal and not adapted to any specific client, trader, or business. Therefore tradeguide.io recommends that you seek professional, financial advice before making any decisions. Results are not guaranteed and may vary from person to person. There are inherent risks involved with trading, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is solely at your own risk, you assume full responsibility. Read Full Risk Disclaimer