The first step in your forex trading journey may be daunting with the many tools for analysis available. But the good news? You don’t have to know every single indicator in order to make money. The most successful traders concentrate on a few reliable forex indicators that give clear and actionable signals. This guide will break down the five most reliable indicators for beginners and teaches you how to utilize them with confidence to implement your strategy for trading.

Successful forex trading relies on technical analysis and indicators act as your compass in unstable currency markets. Instead of betting on price fluctuations they help you make informed decisions based upon the market and established patterns. At the conclusion of this article you’ll know which indicators to focus on and how to mix them for maximum efficiency.

The forex market generates more than $7.5 trillion daily in trading volume which makes it the world’s most affluent financial market. This enormous liquidity provides a wealth of opportunities however, it also means that you require reliable tools to deal with the constant price fluctuations. The indicators we’ll be discussing have been through the rigors of time and are relevant for traders of all levels.

What are Forex Indicators?

The Forex indicator is a mathematical calculation that is based on volume, price or open interest data. They help traders to analyze market trends and anticipate future price changes. Consider them sophisticated instruments that convert market information into visual representations of the charts of your trading.

These indicators are classified into several categories. Trend indicators can help determine the general direction of price movements, oscillators let you know when a currency pair may be overbought or oversold. Volume indicators indicate the strength behind price movements and volatility indicators show how much price fluctuations occur over time.

Modern trading platforms can automatically calculate and display these indicators meaning you don’t have to worry about complicated mathematical formulas. Your task is to read the signals they produce and apply them to your trading strategy.

Why are Forex Indicators Important for Beginners?

New forex traders are often faced with emotional decision-making, which can lead to impulsive trades motivated by the fear of or the desire to be greedy. Forex indicators offer an objective, scientifically-based perspective that eliminates a lot of uncertainty from trading. They serve as a check against your emotions and assist you to keep your focus on the right path.

The indicators can also help beginners spot high-risk trading opportunities. Instead of making trades randomly you can sit and wait for several indicators to align before you risk your capital. This method of planning will significantly increase your chances of success, while decreasing the stress that comes with trading.

In the end, indicators help you develop pattern recognition skills. When you see the way different indicators perform in different situations, you’ll slowly build the knowledge required for long-term success in trading. This process of learning is crucial for the transition from a novice to an experienced independent trader.

Top Forex Indicators for Beginners in 2025

Moving Averages

Moving averages are considered to be the most basic and widely used forex indicators for good reason. They soften price movement by generating a continuously changing average over a particular time period, which makes it easier to determine the trend’s direction.

The two most commonly used are Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). SMAs provide equal weight to all price points during the calculation period, whereas EMAs are more focused on prices that are current and are therefore more receptive to market conditions of the moment.

For those who are just beginning, begin with the 50-period or 200-period moving averages of daily charts. If the smaller moving average crosses over the higher one, it usually indicates the start of an upward trend. In contrast, if the shorter average is below the higher one, it could indicate the beginning of a downtrend.

Moving averages can also serve as dynamic resistance and support levels. Prices frequently bounce off these levels, which can provide an excellent exit and entry point for trades. When there is a strong trend price tends to stay over rising moving averages during uptrends and lower than falling moving averages during downtrends.

MACD (Moving Average Convergence Divergence)

The MACD is recognized as being one of the most flexible forex indicators that traders can use. It blends trend-following and momentum characteristics into one tool, making it especially beneficial for novices who want the most information from a few indicators.

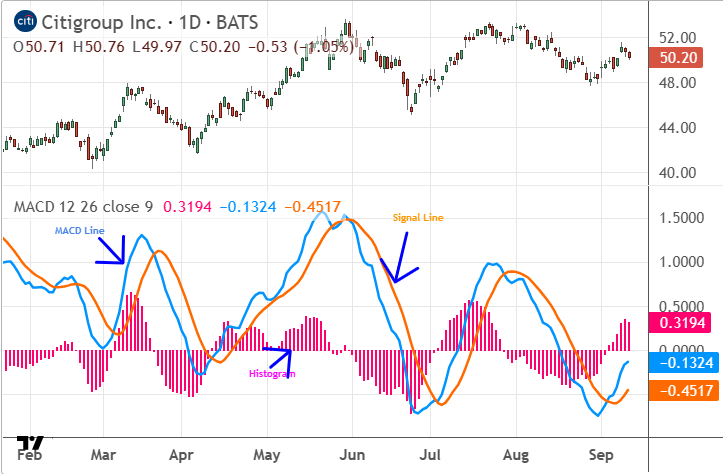

MACD comprises three parts: the MACD line, the signal line and a histogram. The MACD line is the result of the distinction between a slow and fast exponential moving average and the signal line represents a moving average of a MACD line. The histogram displays the differences between the two lines.

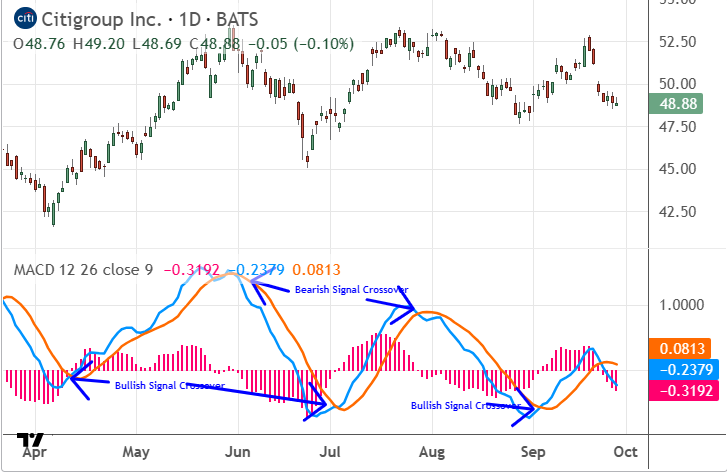

The most frequent MACD signals happen whenever the MACD line crosses either above or below the signal line. A bullish signal is seen when the MACD line crosses above the signal line, which suggests upward momentum. A bearish signal appears when the MACD line crosses below the signal line, suggesting possible downward movement.

Example of Bullish and Bearish signal line crossover

The divergences that exist between MACD and price action are one of the most trustworthy trading signals. When prices hit new highs, but MACD does not confirm its own high, it typically indicates an easing of momentum and a possible reverse. The same rule applies to reverse for potential bullish reverses.

RSI (Relative Strength Index)

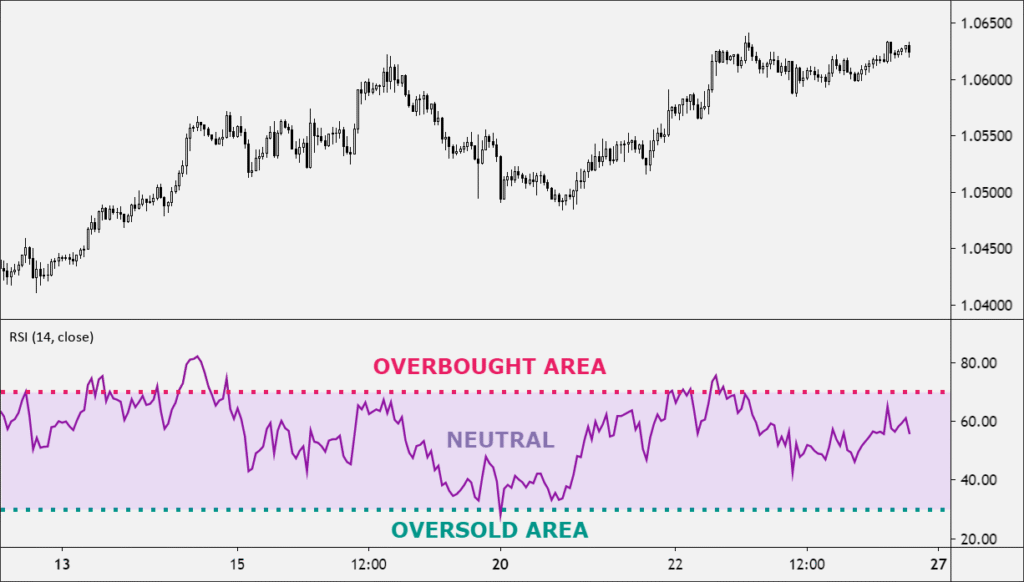

The Relative Strength Index measures the rate and intensity of price changes, which helps traders spot overbought and oversold conditions. The oscillator for momentum ranges from 100 to 0 with readings over 70 considered to be overbought, and readings lower than 30 considered to be oversold.

RSI excels in identifying Reversal points in market trends. When RSI is at its highest it usually indicates that the trend could be losing momentum. But experienced traders understand that RSI can stay at its extreme levels for long periods of time during strong trends, and it is best when paired with other indicators.

The most trusted RSI signals usually occur when price action diverges from the indicator. The term “bullish divergence” is used to describe when prices have lower lows as RSI has higher lows which indicates that the underlying strength is strong even with falling prices. Bearish divergence happens when prices hit higher highs, while RSI creates lower highs which could indicate weakness.

For beginners, concentrate on using RSI to stay clear of entering trades in which momentum is already stretched. If you’re thinking of buying a trade, but RSI is higher than 70, you may prefer to wait for an opportunity to enter the market. Don’t make sell trades when RSI is lower than 30 unless you can prove it with other indicators.

Bollinger Bands

Bollinger Bands comprise three lines that include A middle line (typically a simple moving average) and two outer bands that are two standard deviations higher than and below the middle line. The indicator is able to adapt to market volatility, increasing during volatile times and reducing in quiet times.

The power of Bollinger Bands lies in their ability to detect when prices are stretched beyond their normal limits. When prices are in the vicinity of or exceed the upper range, it could be a sign of overbought conditions. If prices are soaring or fall below the lower bands, it might indicate oversold conditions.

One of the most effective Bollinger Bands techniques is the “squeeze” setup. If the bands shrink dramatically, it usually precedes periods of high volatility as well as strong directional movements. Traders look for the bands to begin expanding again, as a sign that a breakout could be starting.

Bollinger Bands are extremely effective in markets that are ranging where prices tend to move between the lower and upper bands. In markets that are trending the prices may “walk” along one of the bands for prolonged periods of time, therefore it is crucial to take into account the wider context of trends when making decisions about these signals.

Fibonacci Retracement

Fibonacci retracement levels can help identify possible areas of resistance and support in the light of mathematical relationships found by Leonardo Fibonacci. These levels (23.6 percent, 38.2%, 50 percent, 61.8%, and 78.6 percent) frequently act as pivot points when price corrections are occurring within a larger trend.

To utilize Fibonacci Retracements effectively, find an important low and high on your chart and use the technique between these two points. The resulting horizontal lines indicate the places where prices may find support during pullbacks in uptrends and resistance during rallies in downtrends.

The 50 percent and 61.8 percent retracement levels are believed to be the most important, usually offering strong support or resistance. Many traders utilize these levels to establish starting points for trades that are in the direction of the main trend by placing stop losses over the next Fibonacci level for risk management.

Fibonacci Retracements work best when they are paired with other tools for technical analysis. Search for intersections where Fibonacci levels are in line with trend lines, moving averages or earlier resistance and support zones. These confluence zones typically offer the best trading opportunities.

How to Use These Indicators in Combination

While individual indicators can provide valuable information, combining multiple forex indicators can create a more complete trading system. The trick is to find indicators that complement instead of duplicate the signals of each other.

A well-known combination for newbies is to pair an indicator of trend (like moving averages) with an indicator of momentum (like RSI or MACD). This strategy helps to determine the direction of the trend while also determining the best time to enter and exit. For instance, you may only consider buying signals when price is higher than the 50-period average and RSI shows oversold levels.

Another method that works is to combine Bollinger Bands with MACD. Find MACD bearish crossovers when the price is close to the lower Bollinger Band, or bearish crossovers as prices move towards the upper bands. This helps you identify reversal patterns with high probability.

Beware of applying too many indicators at the same time because this can lead to analysis apathy and a conflicting signal. Begin with two or three indicators that complement each other, and then master their interplay prior to adding other instruments to analyze.

Risk Management

A discussion on forex indicators could not be complete without discussing risk management. The best indicators aren’t always reliable which is why an effective risk management system is vital for long-term viability on the market for forex.

Always utilize stop loss to reduce your potential losses on every trade. A good rule of thumb is to risk less than 1-2 percent of your account on a single trade. This makes sure that even a number of losses won’t impact your total capital.

The size of a position plays an important role in managing risk. Larger positions require larger stop loss, which implies taking on larger losses. The smaller positions permit for more tightly-spaced stops as well as better risk management which is especially crucial when you’re still learning how to understand the signals of an indicator accurately.

Be aware of the wider market environment when using forex indicators. In the event of important news events or times that are extremely volatile, indicators could offer more or less accurate signals. Be aware of the calendars for economic events and alter your trading strategy to take into account.

Master These Tools and Start Trading Smarter

Five forex indicators discussed in this article provide the base for the analysis of technical indicators in 2025. Moving averages can help you identify patterns, MACD blends trend analysis and analysis of momentum, RSI indicates overbought and undersold conditions, Bollinger Bands adjust to fluctuations and Fibonacci Retracements identify possible areas of reversal.

Achieving success with forex indicators requires a lot of practice and patience. Begin by examining these tools using demo accounts prior to placing your money on the line. Concentrate on understanding the way each indicator performs under different market conditions instead of looking for the “perfect” indicator combination.

Keep in mind that indicators are instruments not crystal balls. They can boost your chances of success, but they do not assure profitable trades. Combine sound technical analysis with effective managing risk and realistic expectations in order to create an effective trading strategy.

Start with a couple of indicators and then gradually increase your toolbox as your experience increases. The goal isn’t to utilize every indicator that is available, but rather to master a handful of indicators that are compatible with your style of trading and personality. Through consistent study and practice the forex indicators you’ve chosen will grow into effective partners in the trading process.

Subscribe to tradeguide.io get the latest information related to forex trading.

The content provided by tradeguide.io does not include financial advice, guidance or recommendations to take, or not to take, any trades, investments or decisions in relation to any matter. The content provided is impersonal and not adapted to any specific client, trader, or business. Therefore tradeguide.io recommends that you seek professional, financial advice before making any decisions. Results are not guaranteed and may vary from person to person. There are inherent risks involved with trading, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is solely at your own risk, you assume full responsibility. Read Full Risk Disclaimer